This article discusses why there is mega regal opportunity in MRO Procurement Strategy. Top companies develop an MRO sourcing strategy, seize the big opportunities, and overcome implementation challenges. Price related benefits primarily include the unit price reduction of parts but volume discounts, rebates, payment terms improvement are also negotiated based upon long-term contracts. Other benefits include ease of administration from parts and supplier rationalization. One manufacturer was able to realize a total of $32M in price and operational savings. This consisted of $15M from pricing and $17M through operational cost improvements (e.g., inventory management, parts standardization, joint process improvement). We have helped clients in various industries deliver MRO saving of $25M to $76M as shown below.

| Company | Price Savings | Operations Savings | Total |

| Utility Company | $12M | $13M | $25M |

| Specialty Chemco | $15M | $17M | $32M |

| Private Equity firm | $32M | $44M | $76M |

In the business, manufacturing and supply chain areas, the MRO acronym stands for maintenance, repair, and operations. It can also refer to the similar maintenance, repair and operating supplies. MRO refers to any supplies or goods that are used within the production process, but that aren’t part of the final product. MRO purchases include items from earplugs to specialty tools, to abrasives and cutting tools.

Most companies put MRO in the Indirects category of spend, instead of the first-class category of Directs. They say it’s because MRO parts are not core to the business (e.g. engines or metal fabrication). I beg to differ when one considers the total cost of ownership or supply risk mitigation. Think about the possibility of shutting down a production line if there are shortages of certain MRO parts or poor quality.

I have seen situations that cost one production location one million dollars per day. How much could it cost your organization? Wisdom says, Let’s get a strategy and not major in the minor.

- What’s your Sourcing Strategy?

In many organizations, maintenance, repair, and operations (MRO) inventory accounts for a significant slice—as much as 40 percent—of the annual procurement budget. Yet it is still not managed with the level of rigor typically applied to production inventory. A maintenance, repair, and operations (MRO) buyer is responsible for the preparation and issuance of purchase orders for products and services that are used to maintain and fix broken machines. If the process machines are down (due to small or big parts), the company can lose millions of dollars in lost production, brand damage, and late customer deliveries. That makes for a pressurized busy buyer – and a need for a strategic sourcing approach!

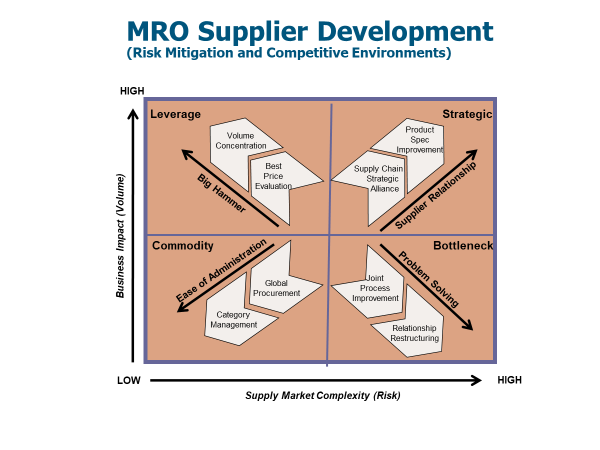

Relative to MRO parts and type suppliers needed, top organizations ask themselves:

- Since all parts are not equally critical or complex, how do we categorize the thousands of parts we buy while maximizing business impact?

- For which critical parts do we need a strategic relationship with our suppliers? Can I get good value through a menu of service level offerings in addition to price?

- Which parts can we aggregate our purchasing volume and use as a negotiation hammer?

- Can we avoid bottlenecks and jointly develop problem-solving process improvements?

- Which parts are commodities, offering ease of administration?

A way to maximize competitive advantage and mitigate supply risk is to construct a four-box that segments the subcategories into strategic, leverage, Commodity and bottleneck. The framework below allows a company to strategize and map how to answer these questions by matching the right parts with select suppliers. In our competitive environment, there are significant inherent supply risks if these strategic questions are not answered or not well executed. Paragon has a process that helps client provide answers and deliver the bottom-line value these questions imply.

2. Small Parts with Big Opportunities

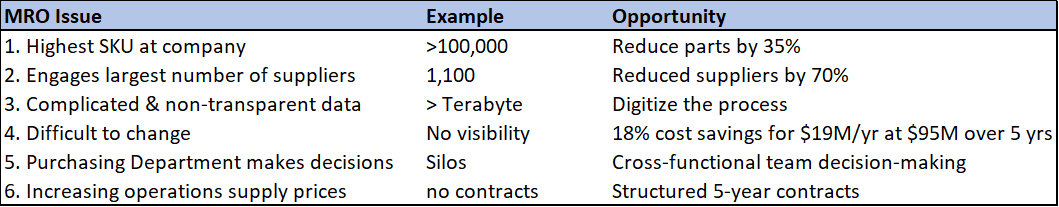

What do we need to think about in order to capture the opportunities? The chart below illustrates that over 5 years, a global manufacturing client’s MRO Procurement Strategy team was able to deliver over $95M of bottom-line savings impact (over $19M annually). The illustration below is an example for a company with $106M of purchasing spend.

These companies have many diverse MRO parts, delivered by a large supplier base (local, regional, and global players). A small buyer group (a band of one in some companies) dealing with over 50,000 parts is not unusual. Opportunity falls through the cracks when time is spent fighting fires rather than sourcing prudently.

The situation is often further complicated by poor data quality driven by an assortment of ERP systems – or no systems at all. A lack of data insight usually causes companies to under estimate the MRO opportunity. Some companies have collectively terabytes of MRO data on spreadsheets in different languages and locations around the world. Few want to do the data mining required to uncover gold.

We have found gold in sourcing a variety of MRO subcategories: control valves, pumps, hoses, fittings, operating supplies, safety supplies, tools, gloves, saws, conveyors, gasket & sealings, fasteners, filters, piping, welding, gasket & sealings, and many others.

MRO Procurement Strategy is about total cost of ownership. Therefore, we help clients go after operational improvements in addition to price reductions. Often the operational improvements bring as much or more value to the business than the transaction and acquisition cost reductions. Uncovering gold in operations is another reason why it’s critical to have cross-functional team members that include operations, engineering, and finance. We have helped clients in various industries deliver saving of $10M to $40M from a wide array of operational projects (e.g., VMI, PO automation, data digitization, parts standardization).

3. Implementation Challenges

There are many things that are as important as price in the MRO community. Don’t make the mistake of talking only to the purchasing department. Ask any operator how important the non-price considerations are! For example, Vendor managed inventory benefits many customers. Vendor-managed inventory (or VMI) is a process in which the buyer of a product provides information to a supplier, and the supplier then takes responsibility for maintaining a set inventory of their product at the customer’s location. VMI may be a good solution if parts are difficult to find, track, or control in disorganized plant storerooms or if buyer resources are limited. It is a way to get supplier resources and reporting as part of your new business practices.

Once agreements are in place, contract compliance is all-important. How do we get compliance: Impeccable implementation?

Many implementation issues/risks can arise when transitioning to new suppliers or when giving a current supplier additional business. We have found that 75% of identified savings opportunities are not realized because of inadequate client execution. Here are a few questions that will allow you to rate your company on implementation readiness:

a. Does your company have a comprehensive MRO implementation check list shared globally?

b. Do we have the right number, type and skilled people to hit key deliverables?

c. Has your MRO Procurement Strategy team developed and communicated standard operating procedures (SOPs)?

d. Do you have a jointly developed detailed MRO supplier transition schedule?

e. Have you identified potentially hostile suppliers? Developed a plan to mitigate supply risks?

f. Do your teams have an issue resolution process with all suppliers? What’s your cycle time?

g. Are mutually agreed upon supplier KPI score cards in place? Are the alliance suppliers performing with excellence? If not, what are you doing about it since time is money?

h. Do you have executive dash boards that proactively reports MRO strategic sourcing performance?

I hope you can now see the Mega Regal Opportunities in MRO!

Melzie Robinson

CEO

Paragon Results LLC

Ph: 630.273.5231

mrobinson@paragonresults.com